Describe the Valuation Bases Used for Marketable Equity Securities

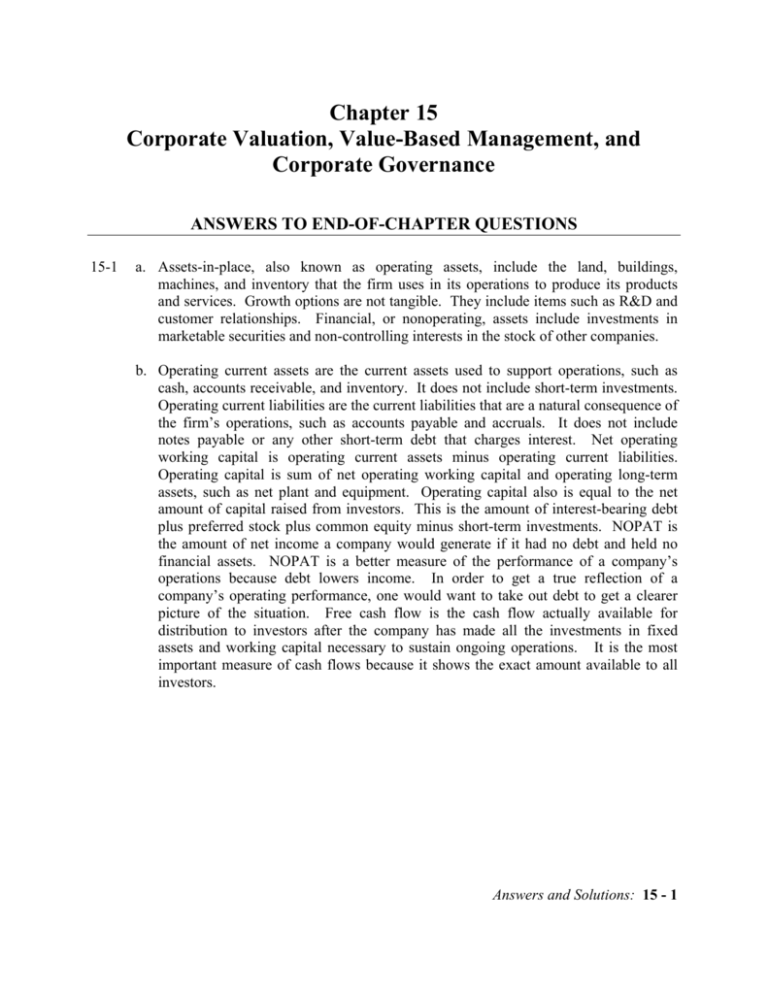

The market approach is a valuation method Valuation Methods When valuing a company as a going concern there are three main valuation methods used. Importance of Equity Valuation.

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

Common Examples Of Marketable Securities

Alright lets talk about marketable securities.

. This term is often associated with an investment in the common stock andor preferred stock of a corporation when the stock is publicly traded. Explain briefly the accounting for stock dividends and stock splits from the investors point of view. The unrealized holding loss of 2040 will be subtracted from the stockholders equity.

Present value of all future cash flows this. The whole system of stock markets is based upon the idea of equity valuation. FIN1FOF Fundamentals of Finance Topic 4 Valuation of Securities 2.

Now were going to talk about marketable securities which again is still 0 to. EP Equity Risk Premium assumed difference bw Rf cost of equity CPi company specific cost of equity assumed diff bw cost of equity in general cost of equity for company Fundamental Stock Selection by Comparing Expected ROR to Required ROR. That was cost 0 to 20 equity 20 to 50.

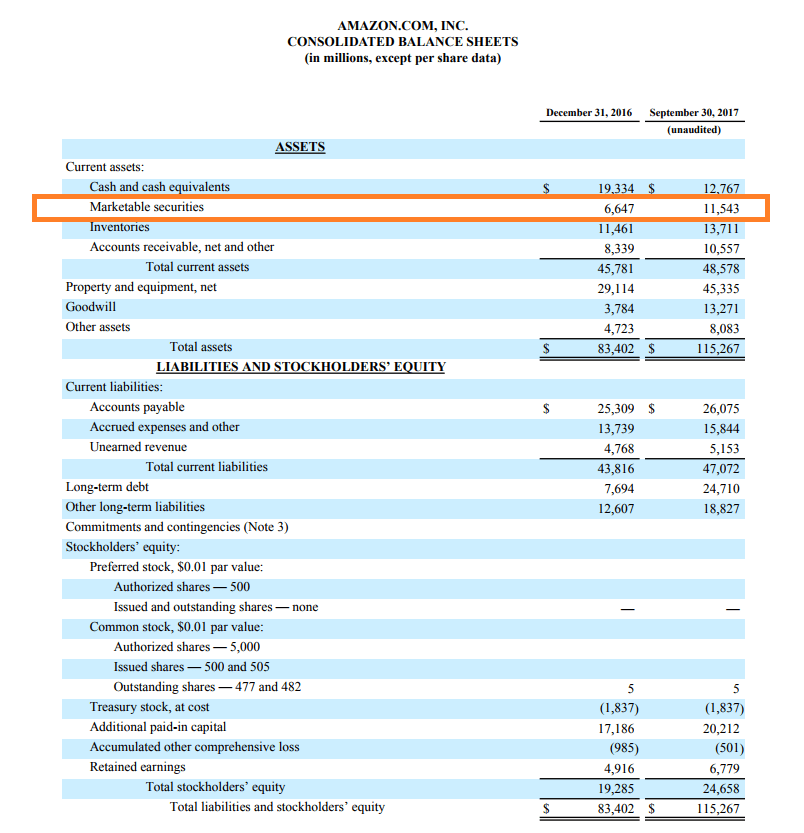

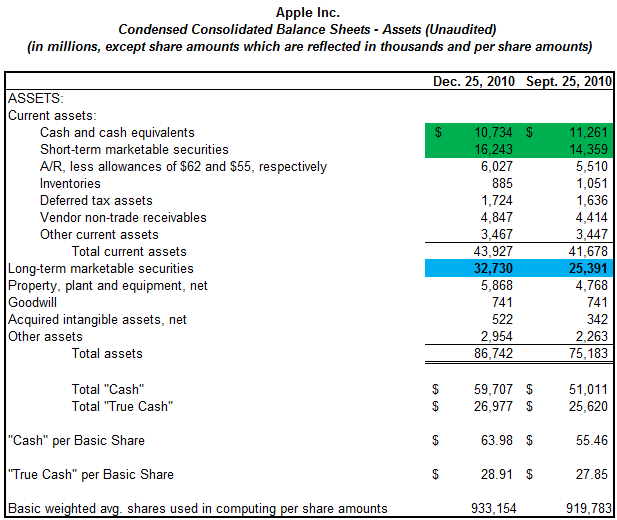

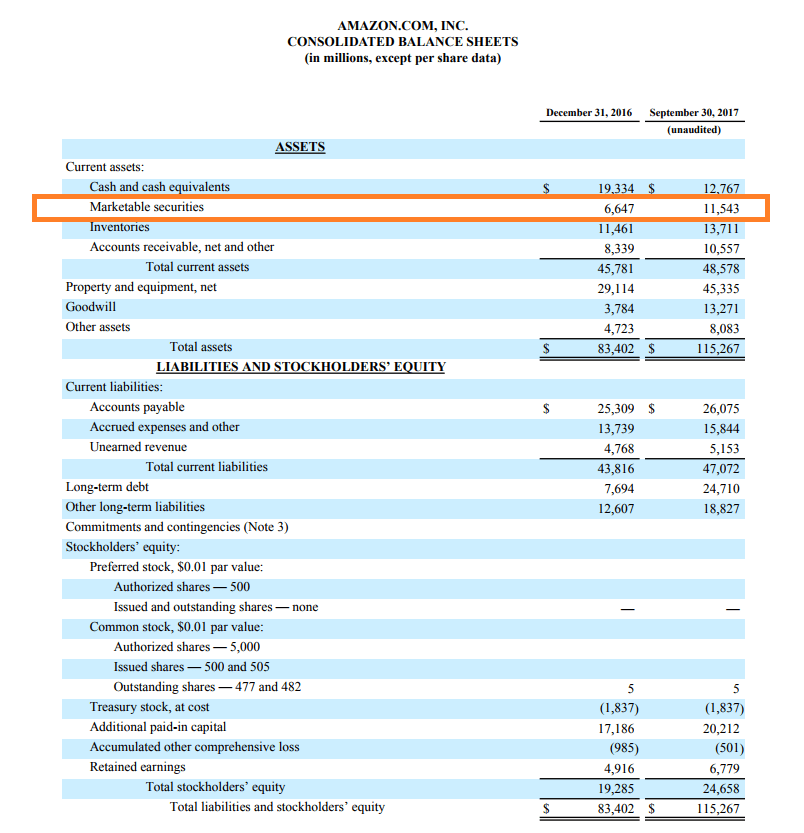

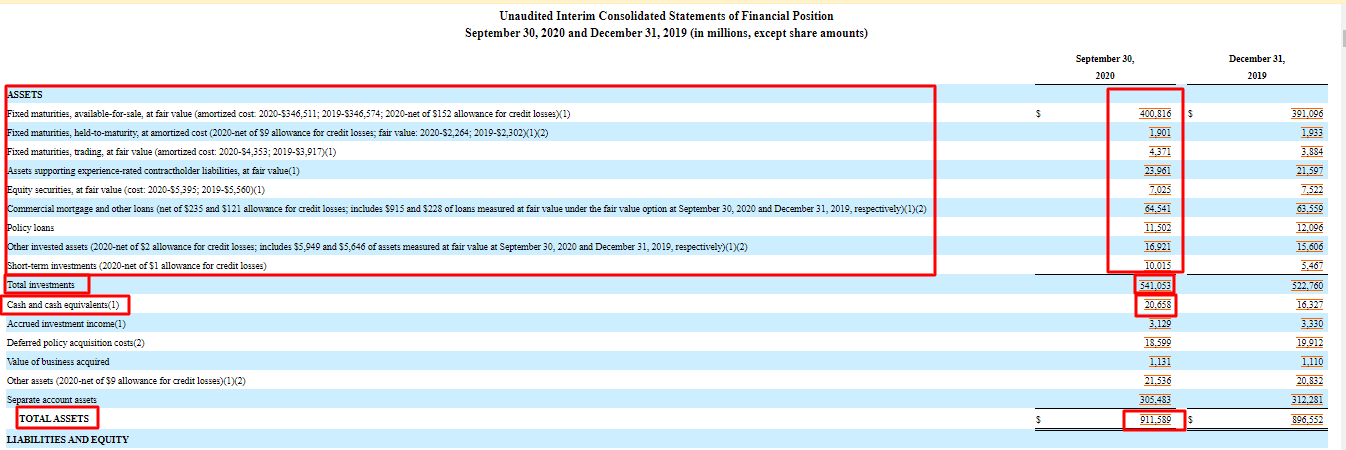

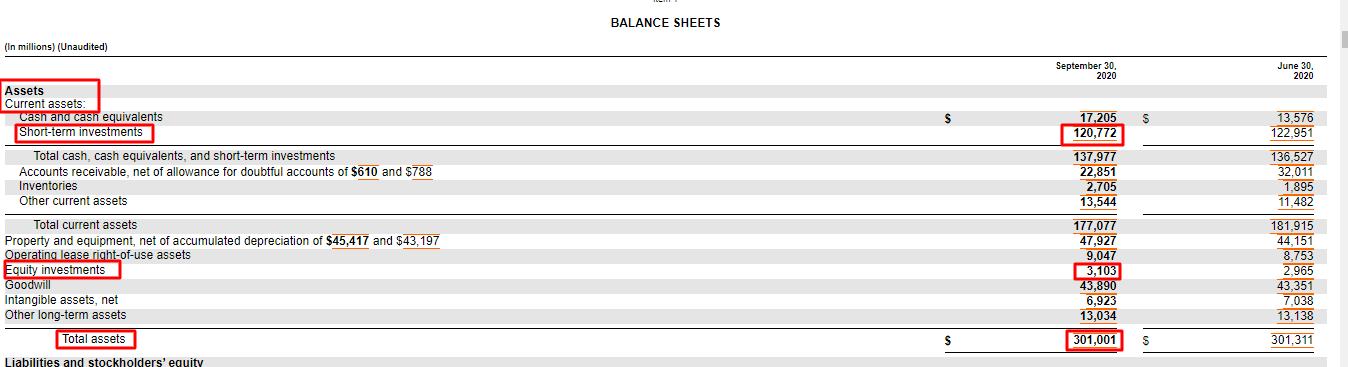

V ddb FV1r n where V ddb Value of a deep discount bond. Three major categories of equity valuation models are present value multiplier and asset-based valuation models. The marketable securities will be shown in the current assets section of the balance sheet at their current market value of 89000.

Inf expected inflation. I would differentiate between pricing and valuation a bit more. 417 Long-term Debt Securities.

Theyre also a way to optimize intercompany agreementsincluding mergers acquisitions and joint venturesas well as hedge many types of risk. The models are- 1. The common type of equity securities is equity and preference shares Preference Shares A preferred share is a share that enjoys priority in receiving dividends compared to common stock.

Depending on the particular purpose or circumstances underlying the valuation this method sometimes uses the replacement or liquidation value of the company assets less the liabilities. Present value models estimate value as the present value of expected future benefits. The par value of a share is the stated value or face value of the equity security.

Equity valuation therefore refers to the process of determining the fair market value of equity securities. The market value may fluctuate around the book value but may be higher if the future prospects are good. Marketable equity securities definition.

Two Stage Dividend Model 3. DCF analysis comparable companies and precedent transactions used to determine the appraisal value of a business intangible asset Intangible Assets According to the IFRS intangible assets are identifiable non. The following formula can be used to determine the value of a DDB.

A companys valuation is essentially a function of its future cash flow Cash Flow Cash Flow CF is the increase or decrease in the amount of money a business institution or individual has. Principle will be used throughout this subject. Unlike debt securities equity securities do no impose an obligation on the issuer to repay the amount financed.

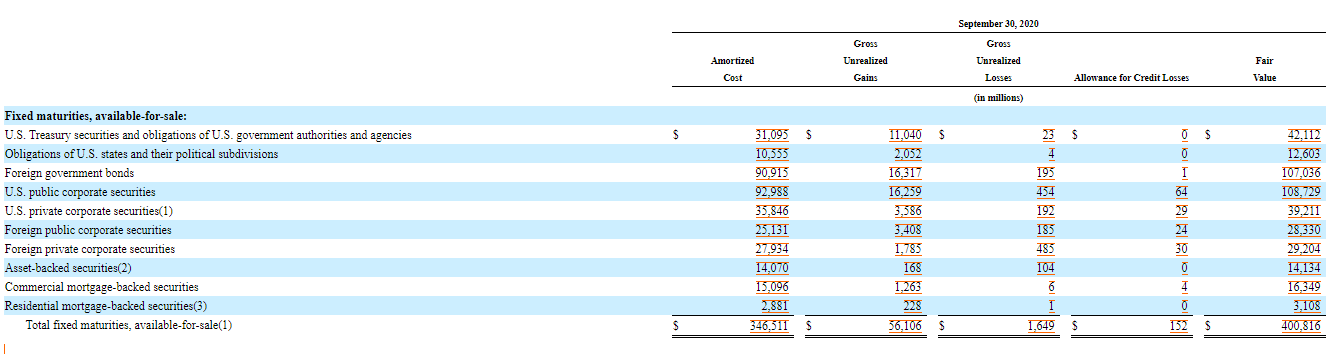

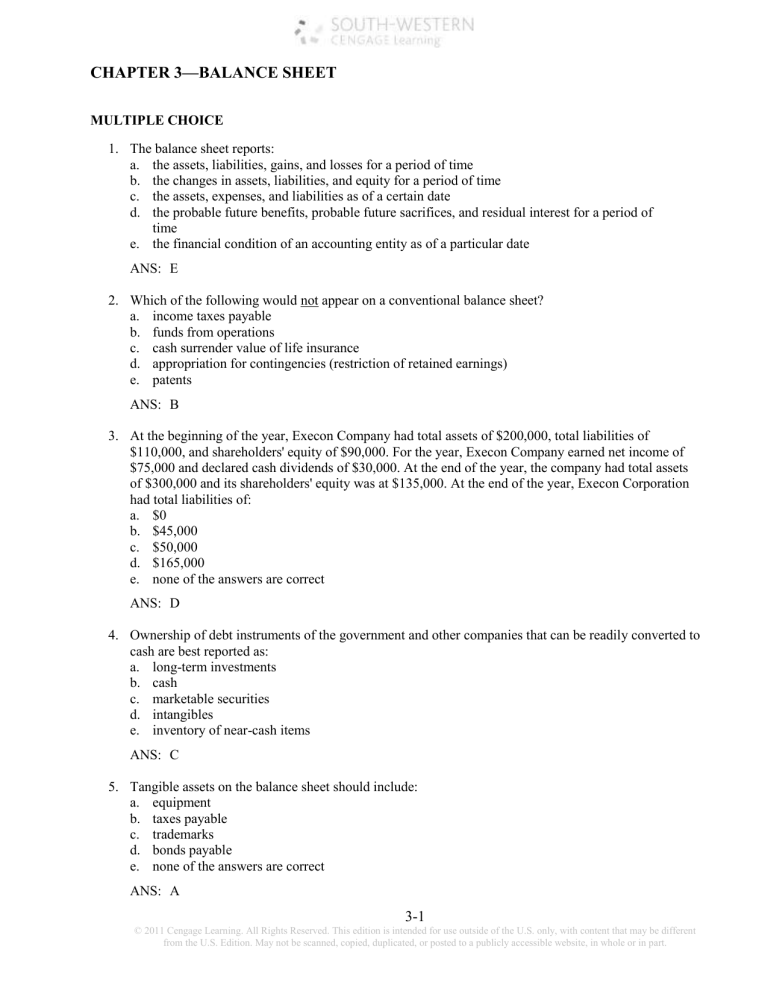

Complex securities can help your business raise capital manage cash flow and provide performance incentives. This method is used to value a business based on the difference between the fair market value of the business assets and its liabilities. Trading securities debt and equity Acquired for short-term profit potential Changes in market value reported in the income statement investment marked to market in the balance sheet Purchases and disposals reported in operating section of SCF Held to maturity debt only Acquired with ability and intent to hold to maturity.

Pricing would indicate that the price of a product or security is set by someone ie. Earnings Capitalisation Model 5. This is done usually by equity analysts.

In other words they are issued without maturity dates. The stock markets have a wide variety of stocks on offer whose perceived market value changed every minute because of the change in information. RRf Real risk free rate.

FV Face value of DDB payable at maturity. I have never heard about pricing a security in this context. Now were still talking about investments.

Some equity securities are issued with a maturity date. In finance it is used to describe the amount of cash currency except in rare situations where net asset liquidation leads to a higher value. N Number of years to maturityLife of DDB.

The value of a financial asset is equal to the. Valuation is the result of investment analysis and the result of coming up with a fair value for a company and its shares. La Trobe Business School.

Many equity securities are issued with an infinite life. We can also make use of the present value tables to simplify our calculations. Equity securities may or may not be issued with a par value.

Dividend Capitalisation Model 4. Types of Equity Securities. When the balance is a net loss it is subtracted from stockholders equity.

The dividend rate can be fixed or floating depending upon the terms of the issue. Constant Growth Model 2. The book value of an equity share is equal to the net worth of the firm divided by the number of equity shares where the net worth is equal to equity capital plus free reserves.

In the balance sheet the market value of shortterm availableforsale securities is classified as shortterm investments also known as marketable securities and the unrealized gain loss account balance of 15000 is considered a stockholders equity account and is part of comprehensive income. Describe the valuation bases used for marketable equity securities. Instead shareholders act as owners of a company with a claim on the companys net assets and expect that management will act in the shareholders best interests.

We just talked about cost versus equity. Some companies lean on complex securities as key. Multiplier models estimate intrinsic value based on a.

R Required rate of return. The following points highlight the top six pricing models used for the valuation of securities. 2000 4552 2000 4450 2040.

Marketable equity securities are equity instruments that are traded on stock exchanges. Under what circumstances is the equity method used to account for stock investments.

Advanced Accounting Fourth Edition Ppt Download

Relative Valuation Valuing A Company Relative To Another

Can An Ira Be A Marketable Security India Dictionary

Marketable Securities In Depth Guide What They Are Valuation And Impact

Marketable Securities Liquid Investments Definition Example

Chapter 7 Financial Assets Chapter 7 Financial Assets Ppt Download

Held For Trading Hft Afs Securities Company Investment Portfolios Guide

Current Assets Formula Calculator Excel Template

Financial Assets Prezentaciya Onlajn

Ppt Statement Of Owner Equity Powerpoint Presentation Free Download Id 307242

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective 7th Edition W By Alibababyt Issuu

Marketable Securities In Depth Guide What They Are Valuation And Impact

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

Common Examples Of Marketable Securities

Marketable Securities In Depth Guide What They Are Valuation And Impact

Comments

Post a Comment